The UK is leading the way

Figures correct as of September 2019. For 2020 figures please see the 'Plant-based foods in Europe' report.

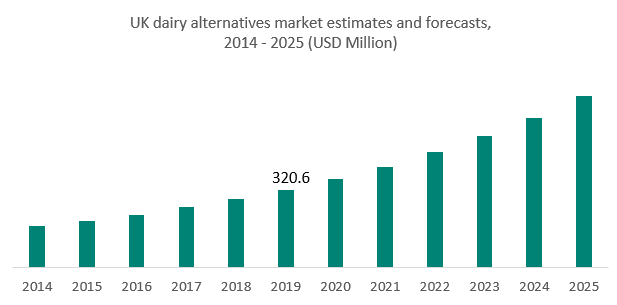

The UK has a strong plant milk market, valued at $320.6 million in 2019, this accounts for approximately 15% of the total European market. By 2025 the value looks to increase by more than double, reaching $705.3 million and growing at an estimated CAGR of 13.8% between the years 2020-2025.

Beverages

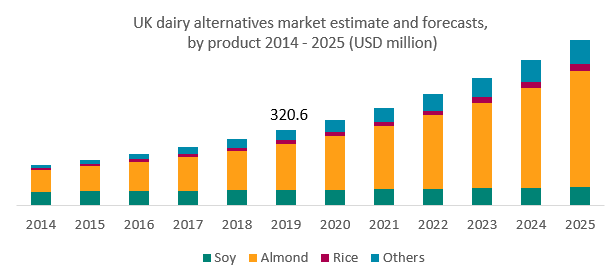

The market for almond milk is set for incredible growth, expanding at an estimated CAGR of 16.6% between 2020-2025. Almond is a popular choice; it’s tasty, creamy, and low in calories, carbohydrates and fat. It is also versatile and works well as an addition to both beverages and meals.

Matching this CAGR of 16.6% is the ‘others’ category. Oat milk has received unprecedented interest in the last year, owing to claims of better sustainability practices and exciting product developments within the category. For example, the Galaxy Oat and Bounty Coconut drinks launched in September 2019 received high praise from the vegan and non-vegan communities alike.

Falling just behind this is rice milk with a CAGP of 14.1% between 2020-2025. New product development within the rice milk category has not taken off to the same effect as other vegan milks, so there is room for market growth and development.

The last category is soy milk. In 2019 this held approximately 20% of the overall plant milk market in the UK. Due to a stagnant CAGR of 2.9% in the coming years, this is set to drop to approximately a 10% share. Soy milk has been a staple plant milk for many years in the UK, however a lack of recent product development within the category may be holding back its appeal.

Foods

In 2019, beverages accounted for approximately 60% of the dairy alternative market and foods accounted for 40%. These categories are expected to grow at a CAGR of 13.8% and 14.2% between the years 2020-2025, respectively. By 2025 the market is set to double in terms of revenue, and the market share between these two categories will remain the same.

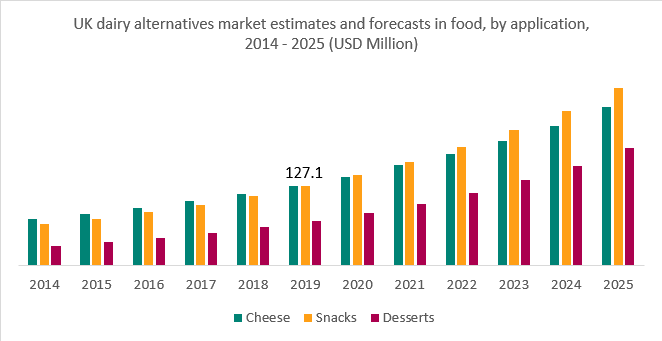

In terms of food products, the dairy alternatives market is set for exceptional growth. Previously, vegan cheese held the highest share of the market. But in 2019, both the cheese and snacks categories levelled out to approximately 40% each, with desserts accounting for the other 20%. Due to varying levels of growth, by 2025 this is set to change.

Vegan desserts have the strongest forecasted CAGR of 17.6% between 2020-2025, which is set to increase their market share to 25%. This has been aided by the launch of several vegan ice-creams coming to market in recent years, such as Northern Bloc’s salted caramel and almond swirl variety. Vegan cakes are also becoming more mainstream, with OGGS launching their selection in June 2019.

Vegan snacks have a forecasted CAGR of 14.4% between 2020-2025, which will help the category in holding its 40% market share in 2025. The development of new vegan chocolates has thrived in recent years. Mars became the first mainstream confectionary brand to release vegan milk chocolates with the launch of three vegan Galaxy varieties in November 2019. Plus, smaller brands are also thriving; Divine, Moo Free and Booja Booja to name a few.

The vegan cheese category has the lowest forecasted CAGR of 11.9% between 2020-2025. For this reason, their market share is set to drop to 35%. Violife has been leading the way in this category, with an abundance of vegan cheeses for all occasions including blocks, soft, slices and grated. Additionally, Applewood released their smoked vegan cheese in October 2019, with 40% of stores selling out on the first day. With results like these, it’s safe to say that there’s room for more innovation

Data from Grand View Research, Inc.