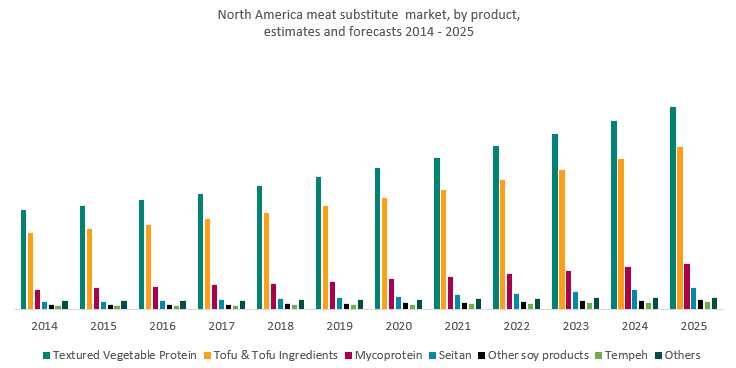

A thriving market in North America

Figures correct as of September 2019.

In 2019, North America accounted for over 30% of the global market and this is set to remain steady in the coming years. Those living in North America have, on average, one of the highest consumption rates of products from animals. Research from Euromonitor states that processed meats make up 42% of the national consumption, which is far greater than any other region (Western Europe is 17%). Switching to vegan alternatives has never been easier, with everyone from independent health stores to huge chain restaurants increasing their offerings.

Seitan may hold a small share of the market, but it is the only segment that is estimated for double-digit growth in North America in the coming years. Increasing numbers of restaurants are adding seitan to the menu, leading to more consumers learning about this versatile ingredient. In fact, this rising interest has even led to more individuals making the product from scratch at home, meaning the product is becoming increasingly mainstream.

The category with the next highest estimated growth between 2020-2025 is mycoprotein. Globally, Quorn dominates this segment – and as of 2019 – is the only widely available form of mycoprotein in the North American market. For this reason, perhaps there is room for more innovation from other brands within the category.

Just behind in terms of estimated growth rate between 2020-2025 is the ‘other soy products’ category. This consists of foods and ingredients made from soya beans such as soy sauce and tamari. These are cupboard staples for many families, meaning their place in the market will always be secure.

Next in terms of estimated growth is the tofu and tofu ingredients segment. This category has historically held a significant share of the market and will continue to do so in the coming years.

Textured Vegetable Protein holds the highest share of the meat alternative market in North America and this market dominance is set to remain. This high protein, low-fat ingredient is relished by vegan food manufacturers for its ability to imitate the shape, texture and flavor of a variety of products. Fry’s has developed a large range of products that make the switch to veganism easy and convenient. Both their fish-style fillets and rice protein and chia nuggets will go down a treat with adults and children alike!

Compared to other segments, the international market for tempeh is still in its infancy. North America accounts for approximately one-third of the global market, yet it has the smallest market share within the region. Despite this, the interest in fermented foods and drinks is on the rise, meaning full innovation within the category is just around the corner.

Finally, there is the ‘others’ category, consisting of products such as mushrooms and jackfruit which are commonly used in vegan cooking. This segment is projected for a stagnant growth rate between 2020-2025. Despite the low market growth, the potential for consumer interest through product innovation remains high. Jackfruit consumption in North America has exploded in recent years, with adventurous consumers seeking new food experiences through exciting flavours and textures.

Data from Grand View Research, Inc.

USA meat alternative market

The US market is reaching record highs

Figures correct as of September 2019. For 2020 figures,...(Read More)