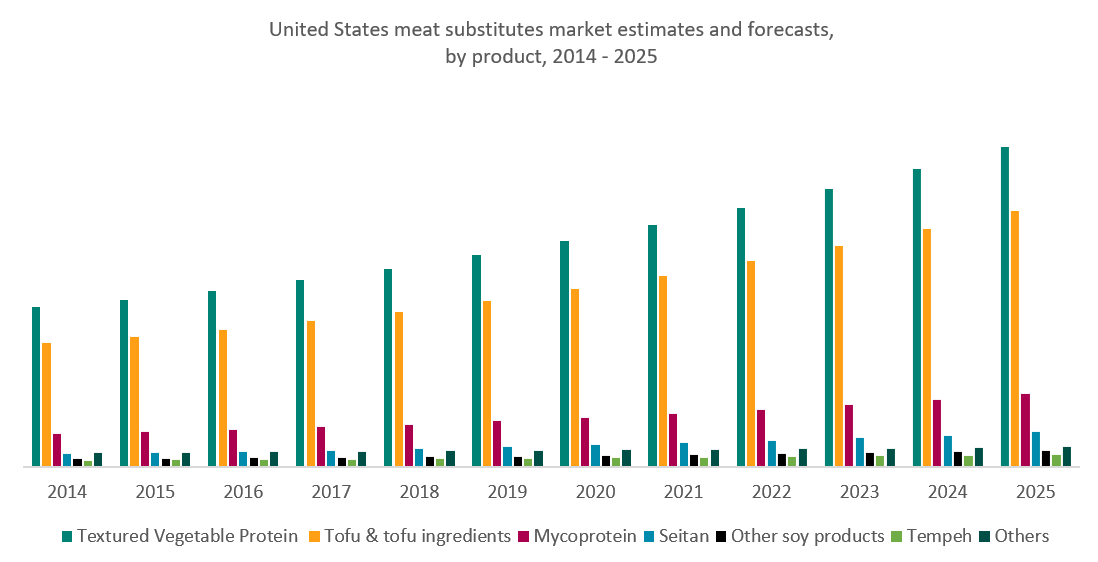

The US market is reaching record highs

Figures correct as of September 2019. For 2020 figures, you can view market research by Good Food Institute.

In 2019, Nielson found that the plant-based meat alternative market in the United States was worth $946.6 million. This market is expected to reach $1 billion for the first time in 2020. The United States accounts for over 80% of the meat alternative market in North America, meaning category-specific growth rates are similar to those presented for the whole region. Research conducted in 2019 found that 80% of Americans intend to replace some or all their meat consumption with vegan alternatives, so the market is ripe for even more innovation.

Seitan accounts for a small percentage of the overall category but is projected to grow with the highest estimated growth rate between 2020-2025, which is set to nearly double the value of the category. Whilst traditionally sold prepacked in its whole form, seitan is increasingly being used as an ingredient in convenience foods such as frozen pizzas or vegan Thanksgiving roasts.

Next in terms of growth rate is the mycoprotein category, which Quorn has dominated for many years. With the lack of other widely available mycoprotein products on the American market, this looks set to continue for some time to come.

Just behind is the ‘other soy products’ category, which consists of items such as soy sauce, used to add savory flavors to a variety of dishes. Because the products in this category can be used across a spectrum of different cuisines, their market presence will remain stable.

Tofu and tofu products are next in terms of estimated growth rate. In 2019, this category held nearly 35% of the meat alternative market. This strong market hold will likely continue in the coming years. As tofu comes in a number of varieties there is something within this category that would appeal to any consumer.

Following this is the Textured Vegetable Protein (TVP) category. Globally, this segment has the largest market share. North America is no different, with TVP accounting for nearly 45% of the whole category in 2019.

Tempeh holds the smallest market share and is also expected to grow with one of the lowest estimated growth rates. Tempeh has only recently started to gain traction in the West, with few retailers utilising its full potential.

Lastly, there is the ‘others’ category. Currently, this segment has a low market presence which could signal untapped innovation and market growth. Certain consumers seek novelty in their shopping habits and behaviors, leading to more spontaneous purchase decisions.

Data from Grand View Research, Inc.